are charitable raffle tickets tax deductible

The organization may also be required to withhold and remit federal income taxes on prizes. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Are Charitable Donations Tax Deductible

The value of your time cost of raffle tickets dues fees donations to individuals donations most foreign organizations contributions homeowners associations donations to political groups or candidates and contributions labor unions and social clubs.

. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. Raffle tickets in order to benefit a nonprofit organization cannot be deducted. Are Donated Sports Tickets Tax-Deductible.

You are engaging in a form of gambling not actually donating funds to a charitable foundation but merely betting that youll win the lottery. A tax-exempt organization that sponsors raffles may be required to secure information about the winners and file reports on the prizes with the Internal Revenue Service. For the purpose of determining your personal federal income tax the cost of a raffle ticket is not deductible as a charitable contribution.

In some cases a portion of the payment made by the donor may qualify as a charitable deduction. Websites like Zacks provided some of the most clarity on how the IRS treats charity raffle tickets. Because of the possibility of winning a prize the cost of raffle tickets you purchase at the event arent treated the same way by the IRS and are never deductible as a charitable donation.

Dues to fraternal orders and similar groups. You cant deduct as a charitable contribution amounts you pay to buy raffle or lottery tickets or to play bingo or other games of chance. Exempt under section 501 of the Internal Revenue Code.

File Your Taxes Absolutely Free From Any Device. Your state may or may not permit charitable nonprofits to conduct raffles Bingo auctions and other games of chance. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

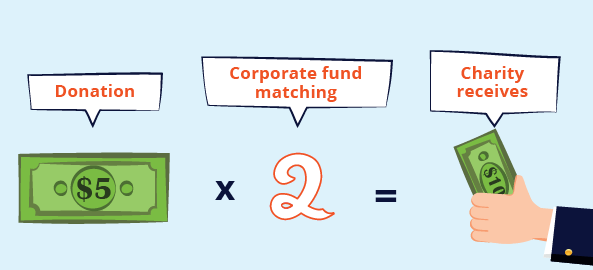

For example if the ticket price is 100 and the fair market value of the food andor entertainment received at the event is 25 per donor the portion of the ticket price that is deductible as a charitable contribution is 75. Basically the IRS treats it like gambling or specifically nondeductible gambling losses because youre not selflessly donating to charity but rather playing the odds in hopes of receiving something of. Are Charity Raffle Tickets Tax-Deductible.

You cannot claim a tax deduction for lottery tickets. The IRS considers a raffle ticket to be a contribution from which you benefit. The revenue ruling holds that the purchasers of the raffle tickets may not deduct the cost of the tickets as charitable contributions under IRC 170.

See How Easy It Is With TurboTax. Are sweepstakes tickets tax deductible. Tuition or amounts you pay instead of tuition.

Thats because you are not actually making a charitable donation but are gambling on the chance that you have the winning ticket. A charity benefit event was held by the charity. For specific guidance see this article from the Australian Taxation Office.

Raffle Tickets even for a charity are not tax-deductible. However if you dont accept the ticket at the time of making the donation or send it back to the charity soon after receiving it you arent receiving a benefit and therefore the entire 100 price is deductible. Are Lottery Tickets Tax-Deductible In Australia.

If you donate property to be used as the raffle prize itself its value may be deductible as a charitable. Raffle tickets are not deductible as charitable contributions for federal income tax purposes. This is because you are betting on the possibility of winning and are not donating money directly to charities.

Unfortunately fund-raising tickets are not deductible. Is a raffle ticket considered a donation. The IRS has determined that purchasing the chance to win a prize has value that is essentially equal to the cost of the raffle ticket.

Get Your Max Refund Today. You cannot deduct the costs incurred in order to support a nonprofit organization through a raffle. It may be deductible as a gambling loss but only up to the amount of any gambling winnings from that tax year.

Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by organizations to raise money. When you accept the ticket but choose to not attend the dinner however the tax rules treat your acceptance of the ticket as a 40 nondeductible benefit since possession of it still. The following are a few examples of charitable contributions you cannot deduct.

If it does it is likely your nonprofit will need to apply for a license from the state beforehand. The IRS regulates games of chance too as well as the taxable income that is earned by victorious game-players. As stated in Rev.

Can a raffle ticket be tax deductible. There is the chance of winning a prize. 67-246 when something of value has.

This is because the purchase of raffle tickets is not a donation ie.

How To Claim Tax Deductible Donations On Your Tax Return

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Are Charity Donations Tax Deductible A Tax Guide For Giving Picnic S Blog

Are Tickets To A Charity Dinner Tax Deductible Uk Ictsd Org

How To Claim Tax Deductible Donations On Your Tax Return

Donation Letter Donation Letter Donation Letter Template Donation Letter Samples

Pin By Heather Dunn On Real Estate Info Competition Info Person

Are Charity Raffle Tickets Tax Deductible Australia Ictsd Org

Sample Donation Receipt Letter Documents Pdf Word Acknowledgement Templates Free Samples Examples For Donation Letter Template Donation Letter Letter Templates

Charitable Deductions On Your Tax Return Cash And Gifts

Tax Relief For Charitable Donations

Bundling Can Provide Tax Advantages Catholic United Financial

Which Charitable Contributions Are Tax Deductible Infographic Turbotax Tax Tips Videos

A Quick Guide To Deducting Your Donations Charity Navigator

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Sample Donation Receipt Receipt Template Tax Deductions Business Template

Tax Deductible Donations An Eofy Guide Good2give

Pin By Shannon Larson On Draw Down Donation Letter Donation Letter Template Donation Request Letters